If the thought of trading grey commutes and instant coffee for a sun-drenched desk in Costa Blanca fills you with glee, you’re not alone. Spain’s Digital Nomad Visa is finally turning the Mediterranean remote-working dream into a reality for non-EU citizens — legally.

But how exactly do you get from “I work from home” to “I work from Spain”? Let’s unpack the steps, paperwork (yes, there’s a fair bit), and everything you need to know to set up your new life under the Spanish sun.

Breathe deeply — this is very manageable with the right guidance.

Who is Spain’s Digital Nomad Visa for?

Spain’s Digital Nomad Visa (Visado para teletrabajadores de carácter internacional) is designed for:

- Non-EU/EEA citizens

- Employees of foreign companies or self-employed freelancers

- Remote workers earning at least €2,760/month in 2025 (200% of Spain’s minimum wage)

- Those with university degrees, vocational qualifications, or 3+ years of work experience

- Individuals with a clean criminal record

Important: You must primarily work for non-Spanish clients (up to 20% of your income can come from Spanish sources).

What you need to qualify

Spain wants to ensure you can support yourself and integrate smoothly. Here’s what you’ll need:

- 💼 Proof of remote work: Employment contract or client agreements

- 🎓 Qualifications: University degree, vocational certificate, or proof of 3+ years’ relevant experience

- 💶 Financial stability:

- 2025 requirement: Minimum income of €33,152 annually (€2,762/month), representing 200% of the Spanish Minimum Wage (SMI).

- If bringing a partner or spouse: Add 75% of the SMI (€12,432 annually).

- For each additional dependant (e.g., children): Add 25% of the SMI (€4,144 annually per dependant).

Example for a family of four (couple + two children):

- Applicant: €33,152

- Partner: €12,432

- Child 1: €4,144

- Child 2: €4,144

- Total required: €53,872 per year

- 📍 Clean criminal record: Apostilled and translated certificate (covering the past 5 years)

- 🛏️ Health insurance: Private policy valid throughout Spain

- 👛 Valid passport: Minimum 12 months remaining

- 👨👩👦 Family documents: Marriage and/or birth certificates, and proof of additional income for dependants

Notes:

- Income proof can come from payroll slips, contracts, freelance invoices, or bank statements.

- Adults working remotely can apply separately, but it’s usually less of a financial strain to apply as a family.

- Freelancers and remote employees applying for Spain’s digital nomad visa must meet the same core income requirement — €2,762/month gross for individuals, with additional amounts for dependents — but face different documentation standards.

- Freelancers must show at least 3 months of ongoing contracts with foreign clients, with no more than 20% of income from Spanish sources.

- Remote employees need a contract from a foreign company that has been officially operational for at least one year and can prove consistent activity.

- Required documentation differs: freelancers submit contracts or invoices, while employees must provide employer certification of company longevity.

- While there’s no fixed minimum bank balance, some Spanish consulates may ask for proof of financial means (e.g., €25,000).

🔍 Always consult your local Spanish consulate for the latest requirements.from payroll slips, contracts, freelance invoices, or bank statements.

How to apply for Spain’s Digital Nomad Visa

There are two clear pathways, depending on where you are:

Option 1: Apply from your home country

- Book an appointment at your nearest Spanish consulate

📍 > Check the official list of Spanish Embassies and Consulates to find the nearest one to your location - Submit your complete documentation

- If approved, receive a 1-year visa, which you can later convert into a residence permit (residencia) once in Spain

Option 2: Apply while already in Spain

Already visiting Spain on a tourist visa? Good news:

- Apply for the residence permit at the Oficina de Extranjería

- Receive a 3-year residence permit, renewable for an additional 2 years

- Application must be submitted while your tourist stay is still valid

Processing time:

- From home country: Around 10–20 working days (may vary)

- From Spain: Around 20 working days, but legally it can extend up to 1–3 months in rare cases

Tax perks for digital nomads in Spain

One major draw? The Beckham Law — yes, inspired by David Beckham himself!

If you apply successfully:

- Pay a 24% flat tax on Spanish-sourced income up to €600,000/year

- Avoid declaring worldwide income for up to 6 years

You must request this tax regime within 6 months of getting your residence permit. It’s highly recommended to work with a tax advisor or gestor.

2025 updates you should know

Spain continues to streamline the process, making it even more attractive in 2025:

- Faster approval times (10–20 days from consulates, around 20 days from within Spain)

- Clearer rules for bringing family members

- Renewals now possible for up to 5 years in total

- Income requirements remain at 200% SMI, with increases for family members (75% extra for the first family member, 25% for each additional)

- Applications from Spain must be submitted electronically through the Large Enterprises and Strategic Collectives Unit (UGE-CE). The foreign company for which you telework must have been operational for at least one year with proven and ongoing activity.

- Successful applicants enjoy access to public healthcare services and can open local bank accounts

Pro tip: Time your tourist entry wisely if applying from Spain to ensure you stay “in status.”

Quick checklist for non-EU digital nomads

Before you dive into the application, gather:

- Valid passport (12+ months)

- Visa/residence permit application forms

- Proof of work and income

- Apostilled, translated criminal background check

- Health insurance policy

- Degree or proof of work experience

- Passport-size photos

- Proof of address in Spain (hotel or rental)

- Marriage/birth certificates for dependants (if applicable)

Why Costa Blanca is the dream destination for most digital nomads

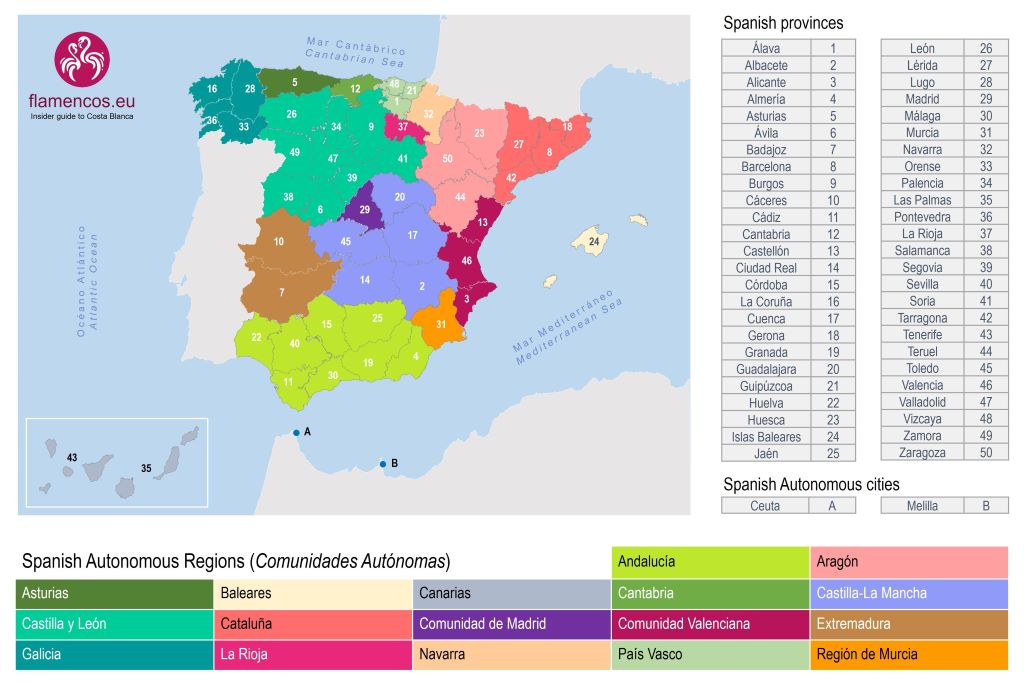

While Spain boasts an endless variety of regions to suit every lifestyle, Costa Blanca – actually, the province of Alicante – stands out because it simply has it all: mountains and beaches, lakes, rivers and seaside promenades, bustling cities and peaceful villages.

According to the Instituto Nacional de Estadística (INE), Costa Blanca has been the preferred area for foreigners settling in Spain for over five decades.

Here’s what makes Costa Blanca the ultimate choice:

- ☀️ 300+ days of sunshine

- 🏖️ Gorgeous beach towns: Altea, Jávea, Denia, Alicante

- 💻 Thriving digital nomad community: Co-working spaces, meetups, and networking events

- 🏡 Affordable living: Lower rents than Madrid or Barcelona

- 🚸 Family-friendly: Excellent healthcare and international schools

- 🛏️ Mediterranean lifestyle: A relaxed pace, vibrant cultural life, and world-class cuisine

Working remotely isn’t just about reliable Wi-Fi. It’s about building a life you love.

Final tip: get help if you need it

Spanish bureaucracy is part of the charm (or the challenge, depending on the day!). To make your life easier, consider hiring:

- 🧑💻 A gestor (trusted admin professional)

- ⚖️ An immigration lawyer

- 🤝 A relocation service

They can help navigate tricky paperwork and save you time (and sanity).

📎 Official sources for latest updates

Always double-check the latest rules directly from the Spanish government:

- Official Ministry of Commerce

- Spain’s Ministry of Foreign Affairs

- Digital Nomad Visa Application – Official site – Government of Spain

- Spanish Tax Agency (Agencia Tributaria) – Information on tax obligations for residents in Spain

FAQs about Spain’s Digital Nomad Visa

Yes! You can enter Spain as a tourist and, as long as you’re within your legal stay, apply for the digital nomad residence permit directly. You’ll initially receive a 3-year residence permit, renewable later.

You must earn at least 200% of Spain’s minimum wage (€33,152 annually or €2,762/month). If bringing family members, add 75% for the first dependant and 25% for each additional dependant.

Absolutely. You can bring your spouse and dependent children. You’ll need to provide marriage and birth certificates and show additional financial resources.

Typically:

From abroad: 10–20 working days

From Spain: Around 20 working days (legally up to 90 days in exceptional cases)

Yes, but only up to 20% of your total professional income can come from Spanish companies.

Yes, once you are registered as a resident, you can access public healthcare. However, you must initially provide private health insurance.

Yes. Time legally residing in Spain under the Digital Nomad Visa counts towards the years needed to apply for Spanish citizenship.

Leave a Reply

You must be logged in to post a comment.